Independent Community Banking

ANBTX is the independent community bank that fits the independent thinking of North Texans to help them in their lives at home and work.

FDIC-Insured — Backed by the full faith and credit of the U.S. Government

FDIC-Insured — Backed by the full faith and credit of the U.S. Government

It Pays To Save With ANBTX

It pays to save with American National Bank of Texas. Grow your savings securely with one of our ANBTX Certificates of Deposit (CDs). Enjoy higher rates with terms to fit your needs… whatever they may be. After all, we’re more than just a bank. We’re Your Bank. For Life.®

Discover More Ways Our CDs Help You Save

![]()

No Maintenance

Fees

![]()

Fixed Interest

Rates

![]()

Online & Mobile Banking

![]()

FDIC

Insured*

![]()

True Local

Banking

What Makes ANBTX Your Bank. For Life.

Since 1875, we've been helping North Texans get more from their bank.

ANBTX is the independent community bank that fits the independent thinking of North Texans to help them in their lives at home and work.

You’re not just any customer—we take the time to get to know you so we can tailor your banking precisely to your needs.

Look to us for personal and business banking, home mortgages, commercial loans, mobile and online tools, wealth management, and more.

![]()

"This bank has absolutely excellent customer service in branch, as well as good rates and fees. They are able to handle issues promptly, and with more personal attention than the Big 3 banks."

![]()

"I have been to several American National Banks of Texas in Terrell, Burleson, and downtown Fort Worth. And all the staff were very friendly & helpful. Every time. A Great Bank to do Business with. I have been a customer over 20 years."

![]()

"The district manager of American National Bank of Texas went above and beyond for me. Very impressed with the service and professionalism. Thank you, Mike."

![]()

"An OUTSTANDING bank with small-town feel and customer service... If you don't wanna be an account number, holler at them."

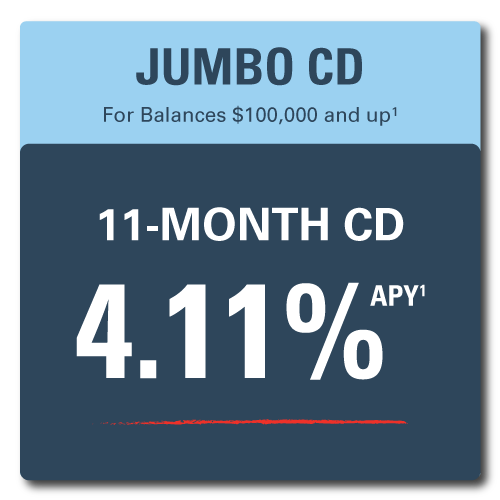

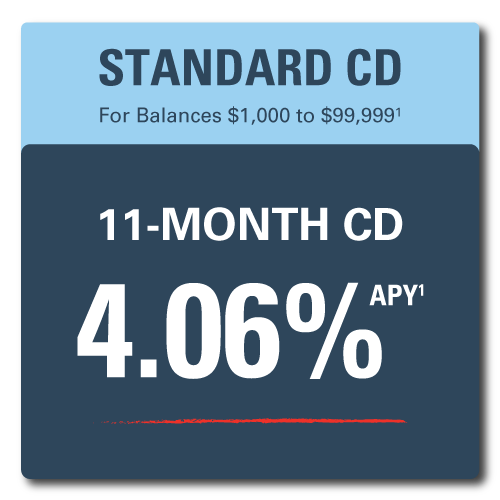

1APY = Annual Percentage Yield as of 02/10/2025 and subject to change until CD is opened. $1,000 minimum balance required to open Standard CD. $100,000 minimum required to open Jumbo CD. Interest is compounded and paid quarterly and at maturity. Once opened, the CD rate will not change until maturity. Fees may reduce earnings. Penalty for early withdrawal.

*FDIC Insured up to the maximum applicable limits.